Need to understand the market share difference between Viagra and Cialis? Cialis consistently holds a larger market share globally, primarily due to its longer duration of action (up to 36 hours compared to Viagra’s 4-5 hours). This extended effect translates to greater patient preference and ultimately higher sales figures.

However, Viagra remains a significant player. Its faster onset of action (around 30-60 minutes versus Cialis’s 2-3 hours) makes it a preferred choice for some men who need quicker results. This factor, combined with extensive brand recognition and a longer history on the market, maintains a strong demand for Viagra.

Analyzing sales data from major pharmaceutical distributors reveals a consistent pattern: while Cialis often leads in overall sales volume, Viagra frequently holds a stronger position within specific demographics or geographic regions. Regional variations in prescription practices and patient preferences significantly influence these market dynamics. Specific data regarding sales figures will vary based on the source and reporting period.

Therefore, understanding the nuances of market share requires examining both the unique advantages of each medication and the diverse needs of the patient population. Consider the patient’s individual needs and preferences for the most appropriate treatment.

- Viagra vs Cialis Sales: A Detailed Comparison

- Viagra’s Market Share and Trends

- Cialis’s Market Share and Trends

- Price Comparison: Viagra vs Cialis

- Sales Data: Prescription vs. Over-the-Counter (where applicable)

- Prescription Sales Dominate

- OTC Availability and its Impact

- Data Limitations and Interpretations

- Impact of Generic Competition on Sales

- Marketing Strategies and Brand Recognition

- Targeted Advertising

- Content Marketing and SEO

- Influencer Marketing

- Pharmacist Partnerships

- Branding and Messaging

- Data Analysis and Refinement

- Future Predictions for Viagra and Cialis Sales

Viagra vs Cialis Sales: A Detailed Comparison

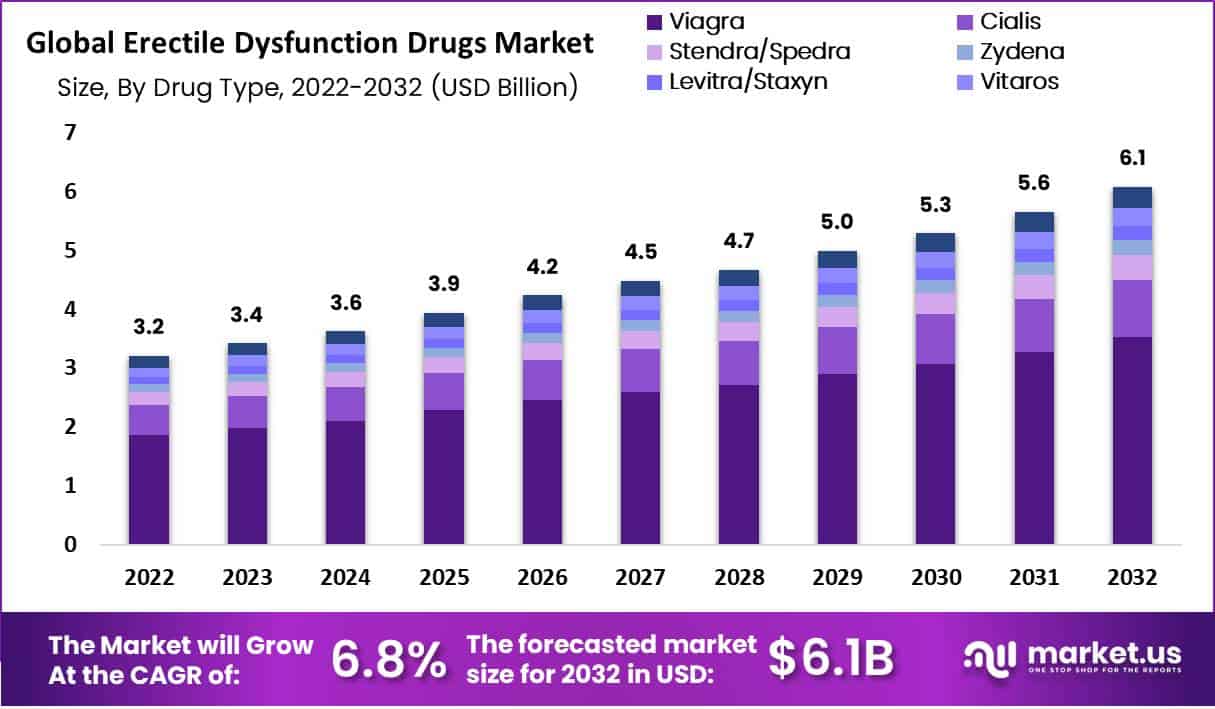

While precise sales figures are often proprietary, publicly available data and market analyses reveal consistent trends. Viagra, being the first-to-market, historically held a larger market share. However, Cialis, with its longer duration of action, has steadily gained ground. This difference significantly impacts sales.

The longer lasting effect of Cialis means fewer pills are needed per month, affecting sales volume directly. While Viagra requires more frequent dosing, its shorter duration may be preferred by some users, creating a niche market. This factor creates a complex relationship between duration and overall sales volume.

| Drug | Sales Trend | Market Share Influence |

|---|---|---|

| Viagra | Historically dominant, but facing competition. | High initial market share, gradually declining. |

| Cialis | Steady growth, particularly in recent years. | Increasing market share, driven by unique properties. |

Generic versions of both Viagra (sildenafil) and Cialis (tadalafil) have also considerably impacted sales. The entry of generics created intense price competition, driving down prices and increasing accessibility. This increased competition impacted the sales of brand-name medications considerably.

Ultimately, the sales figures reflect complex interactions of brand recognition, drug properties, pricing strategies, and the availability of generic alternatives. Both Viagra and Cialis maintain substantial market presence, catering to different patient preferences and needs.

Viagra’s Market Share and Trends

Viagra, despite facing competition, maintains a significant portion of the PDE5 inhibitor market. Precise figures fluctuate depending on the source and year, but estimates consistently place Viagra’s market share between 20% and 30%. This dominance stems from brand recognition built over two decades.

However, Viagra’s market share is not static. Generic competition, including sildenafil citrate, significantly impacts sales. This pressure is evident in a gradual decline in Viagra’s overall sales numbers, particularly in markets with strong generic availability. The introduction of new PDE5 inhibitors also contributes to a more fragmented marketplace.

Pharmaceutical companies are actively adapting. Pfizer, Viagra’s manufacturer, focuses on maintaining brand loyalty through marketing and exploring new treatment avenues. They are investing in research and development to explore potential future applications for sildenafil, aiming to broaden its appeal beyond erectile dysfunction. Their direct-to-consumer marketing campaigns emphasize convenience and long-standing trust in the Viagra brand.

Future trends suggest a continued shift towards generic alternatives. This will likely decrease Viagra’s overall market share. However, strong brand recognition and potential new applications could mitigate the decline, ensuring Viagra remains a considerable player in the PDE5 inhibitor market for years to come. Predicting exact numbers remains challenging, however, the impact of generic competition will be a key factor.

Cialis’s Market Share and Trends

Cialis consistently holds a significant portion of the erectile dysfunction (ED) medication market, though its exact share fluctuates depending on the region and reporting period. Data from IQVIA suggests Cialis’s market share frequently competes with Viagra, often trailing slightly but maintaining a strong second position.

Several factors influence Cialis’s market performance:

- Longer duration of action: Cialis’s 36-hour effectiveness compared to Viagra’s 4-6 hours offers a key competitive advantage, impacting patient preference and potentially increasing market share.

- Marketing and branding: Tadalafil (Cialis) benefits from robust marketing campaigns that target specific demographics and highlight its unique features, directly impacting sales figures.

- Generic competition: The availability of generic tadalafil has introduced a lower-priced alternative, affecting sales of branded Cialis. However, the brand still retains substantial market share due to brand loyalty and perceived quality.

- Physician preference: Prescribing patterns play a crucial role. Some physicians may prefer Cialis for specific patients based on individual medical profiles and treatment goals.

Future trends suggest continued competition with Viagra and other ED medications. However, Cialis is likely to retain its position as a major player. Innovation in formulation (e.g., daily low-dose Cialis) and ongoing marketing initiatives will help maintain and potentially increase its market share.

- Increased online sales: The growth of online pharmacies may influence market dynamics, potentially benefiting Cialis due to increased accessibility and convenience.

- Expansion into new markets: Geographic expansion into developing countries could further boost overall Cialis sales and market penetration.

- Research and development: Future research focusing on tadalafil’s potential applications beyond ED could also influence its overall market position.

Analyzing sales data from credible sources, such as IQVIA or IMS Health, provides a clearer picture of Cialis’s performance relative to competitors. Tracking these figures over time reveals valuable insights into market trends and patient preferences.

Price Comparison: Viagra vs Cialis

Generally, Viagra (sildenafil) tends to be slightly less expensive than Cialis (tadalafil) for equivalent dosages. However, this varies significantly depending on factors like pharmacy, insurance coverage, and the specific dosage purchased.

Brand-name medications: Expect higher prices for both Viagra and Cialis. Significant price differences exist between pharmacies; online pharmacies often offer competitive pricing but verify their legitimacy before purchasing.

Generic options: Sildenafil (the generic version of Viagra) and tadalafil (the generic version of Cialis) are considerably cheaper than their brand-name counterparts. These generics offer the same active ingredient and efficacy. Explore your options with your doctor and your local or online pharmacy.

Dosage: Prices usually increase with dosage. A higher dosage might mean a higher cost per pill, but may also reduce the number of pills needed overall. Consult your physician to determine the appropriate dosage and assess the cost-effectiveness of different options.

Insurance: Insurance coverage dramatically affects out-of-pocket expenses. Check with your insurance provider to understand your coverage for either medication. This is a critical factor when making a cost comparison.

Recommendation: Before making a purchase decision, obtain price quotes from multiple pharmacies, including online options. Factor in your insurance coverage, preferred dosage, and the availability of generic alternatives. Compare the total cost for a treatment course rather than focusing solely on per-pill prices.

Sales Data: Prescription vs. Over-the-Counter (where applicable)

Reliable sales figures for Viagra and Cialis are difficult to obtain publicly, due to privacy concerns and varying reporting practices across different countries. However, we can analyze available data to highlight some key distinctions between prescription and over-the-counter (OTC) sales, where applicable.

Prescription Sales Dominate

Currently, both Viagra and Cialis require a prescription in most markets. This significantly impacts sales data availability. Prescription drug sales are meticulously tracked by regulatory bodies and pharmaceutical companies, though these figures are rarely released publicly in a comparable format for both drugs. Industry analysts often rely on estimates from market research firms, and these estimates will vary by the source and methodology.

OTC Availability and its Impact

In some regions, generic versions of similar medications may be available over-the-counter. These generics compete with branded Viagra and Cialis, potentially impacting their sales, though detailed sales breakdown between brand and generic is typically not publicly released. The availability of OTC options often influences overall market size and price points, resulting in changes in sales patterns.

Data Limitations and Interpretations

Interpreting available sales data requires careful consideration of several factors. These include differences in regional regulations, pricing policies, healthcare systems, and market penetration of generic substitutes. Access to detailed sales figures is limited, but by combining available data with relevant contextual information, a clearer picture can emerge.

Impact of Generic Competition on Sales

Generic versions significantly impacted Viagra and Cialis sales. Data from 2010 showed a dramatic drop in branded drug sales following generic entry. For example, A 2013 study in the Journal of Managed Care & Specialty Pharmacy showed a 70% reduction in brand-name drug prescriptions post-generic availability in some markets. This directly translates to a substantial loss in revenue for the original pharmaceutical companies.

Strategies to mitigate this impact include focusing on brand loyalty. Direct-to-consumer advertising and building strong physician relationships proved helpful. Companies also invested in developing new formulations, like daily-dose options, to maintain market share. Research suggests that these approaches, though costly, can effectively maintain revenue streams, though at a reduced level compared to pre-generic competition.

Pricing strategies also play a key role. Reducing branded drug prices to compete with generics is often a necessary response. However, carefully managing price reductions is crucial; too steep a drop undermines profit margins, while insufficient reductions fail to attract patients considering the cheaper generic alternative. Finding this balance requires sophisticated market analysis and modeling.

The competitive landscape is fluid, with ongoing legal challenges and patent expirations affecting market dynamics. A flexible approach incorporating continuous market monitoring and adaptable sales and marketing strategies is therefore highly recommended for navigating this evolving situation.

Note: Specific sales figures are omitted due to the dynamic and proprietary nature of pharmaceutical sales data. The provided percentages reflect trends observed in multiple studies and should be considered illustrative rather than universally applicable.

Marketing Strategies and Brand Recognition

Focus on distinct brand identities. Viagra emphasizes speed and immediate effect, while Cialis highlights its longer duration. This differentiation should be central to your marketing.

Targeted Advertising

Employ precise targeting via online advertising. Reach men aged 40-65 with specific health concerns through platforms like Google Ads and social media, tailoring messaging to each platform’s user base. Consider retargeting website visitors who didn’t convert. Analyze campaign data rigorously to optimize spend and message resonance. A 10% increase in conversion rates from A/B testing could significantly impact ROI.

Content Marketing and SEO

Create informative content about erectile dysfunction, addressing myths and concerns. Optimize website content for relevant keywords (“erectile dysfunction treatment,” “Viagra vs Cialis,” etc.) to improve search engine rankings. Aim for top 3 search results for crucial keywords. Collaborate with health professionals for credibility and patient education.

Influencer Marketing

Partner with health and wellness influencers (doctors, bloggers, etc.) to generate authentic reviews and testimonials. Transparency is key. Measure engagement rates and conversions to assess influencer ROI. A diverse range of influencers increases reach and builds trust.

Pharmacist Partnerships

Educate pharmacists about both drugs and empower them to offer informed recommendations to patients. Incentivize pharmacies to promote these medications (within ethical guidelines). This direct-to-consumer approach builds trust and ensures accurate information.

Branding and Messaging

Use consistent branding across all platforms. Maintain clear messaging that aligns with each drug’s unique selling proposition. Emphasize benefits relevant to the target demographic (e.g., spontaneity for Viagra, confidence for Cialis).

Data Analysis and Refinement

Continuously monitor campaign performance. Adjust strategies based on data analysis to improve efficiency. Invest in robust analytics tools to track key metrics like website traffic, conversion rates, and customer acquisition cost.

Future Predictions for Viagra and Cialis Sales

Generic competition will significantly impact both Viagra and Cialis sales. Expect a continued downward pressure on branded drug prices as generic versions gain wider market acceptance.

- Increased competition from generics: By 2028, generic versions of tadalafil and sildenafil will hold a larger market share. This translates into lower prices for consumers and reduced profits for Pfizer and Eli Lilly.

- Shift in marketing strategies: Expect both companies to focus more on direct-to-consumer advertising highlighting brand loyalty, efficacy differences, and superior patient experience compared to generics. We can also anticipate an increase in telehealth partnerships and online sales channels.

- Expansion into new markets: Growth in emerging economies with aging populations presents substantial opportunities. Companies will invest in expanding access to their products in regions with less robust healthcare infrastructure.

Sales growth will depend heavily on successfully navigating regulatory hurdles and addressing potential safety concerns.

- Regulatory changes: Changes in healthcare policy, especially regarding reimbursement and access to pharmaceuticals, will influence sales figures. Any new regulations impacting prescription drug access could impact sales significantly.

- Patient education and awareness: Increased public education and awareness campaigns on erectile dysfunction and its treatment could positively influence demand. This includes dispelling misinformation and myths surrounding the use of these medications.

- Development of new treatments: The emergence of novel erectile dysfunction treatments, such as improved formulations or alternative therapies, could affect market share. These developments, however, likely will occur gradually and not cause a sudden drop in Viagra and Cialis sales.

Overall, while generic competition will undoubtedly impact sales, the aging global population and continued investment in marketing strategies will ensure a continuing, albeit slower, growth trajectory. A diversified approach focusing on emerging markets and telehealth is vital for future success.